How To

The Protein Trend is HOT and Growth is Expected to Grow

Sales of ready-to-drink protein products totaled £16.7m last year, up from £5.6m in 2007. But that figure is expected to climb to £51.7m in the next four years, with the overall protein product market more than doubling to £362m, according to Euromonitor International.

New Nutrition Business (NNB) notes the top two trends in 2014 for Food, Nutrition & Health are Naturally Functional and Dairy 2.0, suggesting protein enhanced dairy products are well positioned for growth.

Naturally Functional – the natural halo of the ingredient, in this case protein from dairy, legitimizes the product and consumers are drawing their own conclusions with no health claim needed. It’s natural and it’s functional. We have seen astronomical success in naturally functional with Coconut water and are starting to see leading products emerging in dairy.

Dairy 2.0 – dairy already has a naturally healthy image and has been used for years as a credible category for healthy messages. Initially benefits surrounded calcium and added ingredients but as science progresses we are now seeing claims focus around protein and natural with benefits such as immunity and satiety. The Dairy 2.0 strategy has already produced possibly the most successful product launch ever –worldwide – in the dairy category, Danone’s Oikos

Greek yoghurt (NNB).

Where to Play to Achieve Scale?

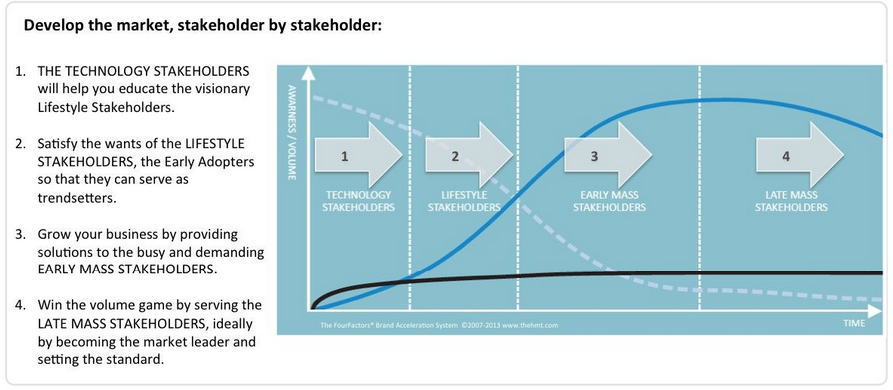

The HMT Innovation Lifecycle Model links together four stakeholder groups that make up the healthy foods market. Our experience shows that to win in the market place, it is important to develop the market from left to right. From high-value, niche categories through to the high-volume mass markets.

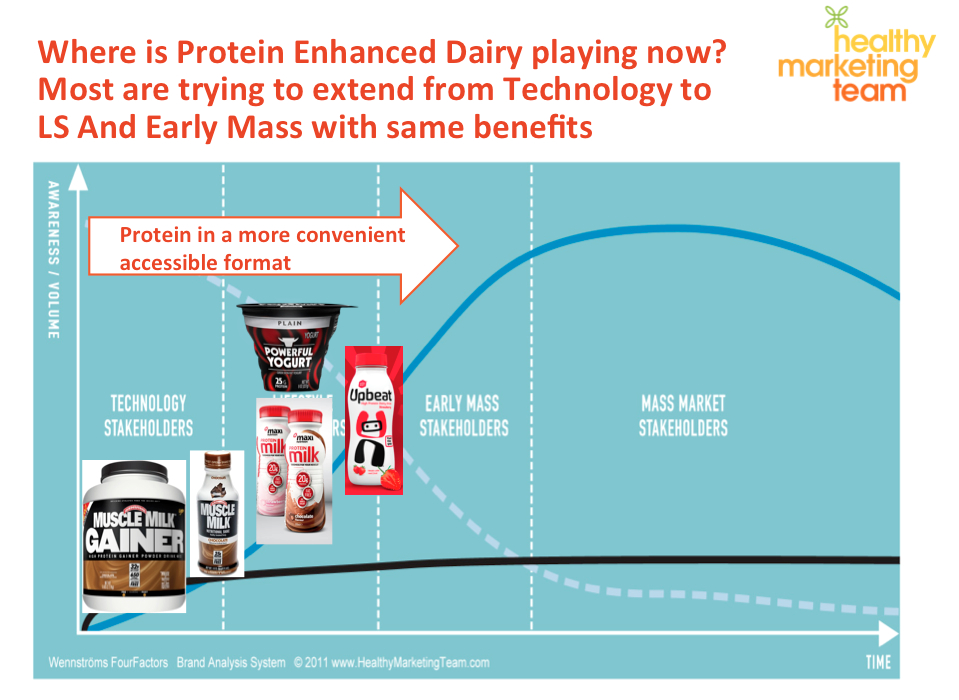

In accordance with our model, the protein supplement category launched within the Technology Stakeholder segment in a powder format as a convenient alternative to consuming chicken or fish after a serious workout (with a muscle recovery benefit). As the trend has evolved and consumer awareness of protein and its benefits has increased, we are now seeing Lifestyle and Early Mass consumers looking for broader benefits (weight management, satiety, general nutrition) with more convenient and tastier options.

Though higher price premiums can be achieved in the Technology segments, real scale for protein enhanced dairy products can best be achieved with the Mass or Early Mass Market Stakeholder. A fact we are not the first to observe as we note a number of brands trying to extend into Lifestyle and Early Mass with technology benefits e.g For Goodness Shakes, Powerful Yogurt.

Looking to our new consumer targets in Early Mass and Mass Market, the question remains “why do I need more protein in my day? How does it make my day better?”

What do Everyday Consumers Really Want?

It is simple. Consumers want the pleasure of real food with a clear single-minded benefit, whether guilt-free pleasure or keeping the hunger at bay e.g. Danone Oykos and Danio.

The opportunity here then is to differentiate on consumer needs rather than on ingredients and shifts focus from technology to psychology as we have seen Weetabix do recently with their on-the-go breakfast drink (Weetabix TVC). The product tackles the biggest need of the everyday consumer, energy, but offers convenience and taste first. They have made a brand originating in the Mass / Early Mass segments fit to capture the growth.

We have also noted an emerging segment for protein enhanced dairy products in mass market, helping Mum keep doing the best for her kids each day. In the US, 47% of mums are seeking more protein for their kid’s diets (2010 Gallup Study).For example a yoghurt from a trusted brand that is already established within the family’s everyday repertoire will be well positioned to fuel Mum’s ambition for her family e.g. GoGurt. We also see that this would be particularly relevant in growth markets where successful kids brand leverage the ER factor (taller, stronger, sharper etc).

Become a Leader: Now is the Time to Sharpen your Innovation Strategy

As H&M decided they would no longer wait for fashion trends and now lead with their consumer, you too as a dairy player should take the lead in democratizing protein by making it desirable and useful for your consumer.

Success will come from choosing the right innovation strategy for your brand and your business. Building scale for protein enhanced dairy products can be achieved through creating a New Category Segment (e.g. Avonmore’s weekend warrior) or a Whole Category Substitution (Weetabix breakfast fuel). Each strategy plays by different rules which you must acknowledge and only then develop the perfectly balanced FourFactors® concept.

There are plenty of opportunities for real growth and scale in the protein enhanced dairy market. As the market continues to segment and consumer awareness and acceptance of the ingredient continues to grow, the right innovation strategy and the right positioning of your product will be critical.

If you would like help with your brand or benefit strategy, please get in touch with me and I would be happy to offer a free brand diagnostic meeting or discuss the market trends further.